Credit Scores – Check Out The Dark Side Of These Numbers

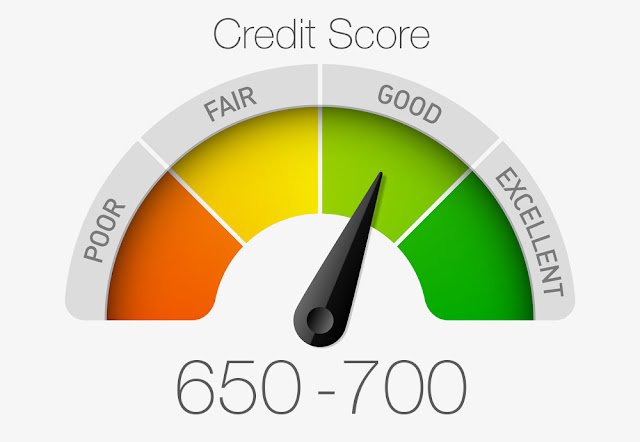

It is a known fact that credit scores are quite important and play a major role in our financial lives. Unless you have maintained excellent credit scores, it will be difficult for you to qualify for a mortgage or any kind of unsecured loan. Unless you know how to manage your credit well, you will be in a complete mess.

Contents

Mixed files and the havoc they cause in our lives

Credit bureaus have to manage number of credit files regularly. Thus, the problem of mixed files is quite common. There are many people who face this issue. A case of mixed file happens when someone else’s information gets reported to your credit report and impacts your credit score in a negative way. The negative trade lines, if any, of the other person gets reported in your credit file and lower your score. Disputing it does not work most of times. The computers may wrongly verify the information without doing any investigation. Moreover, even if the dispute works, it may again get back to your credit report and lower you scores once again.

Pre-approved credit card offers and scores

You will find that you get continuous pre-approved credit card offers in the inbox of your e-mail. This might give you an idea that you have a good credit score. Thus, for months, you may not check your credit scores and report. But you should always remember that it is a marketing strategy of the credit card issuers to offer credit cards to everyone. Later on, when a person takes up the card, they decide upon the interest rate charged after checking his or her credit scores formally. As a result, you will find that these credit card issuers can easily send credit card offers to people who have recently gone through a bankruptcy or a foreclosure. Thus, don’t believe on these offers and always check your credit scores on a regular basis to avoid facing the darker side.

Can credit scores be color-blind?

When we speak of the darker side of credit scores, we will have to look out whether or not the credit scores are color blind. This actually means that we need to know how they affect the minorities. It should be noted that many consider credit scores to be color blind as they are solely based on the information provided on the credit report. But as every culture has their own way of judging and deciding on finances, what gets reported on the credit report may not give you the full picture. There are many communities who are responsible about their finances and pay their loans and rents on time but don’t like to use credit cards. As ample revolving credit does not get reported on their credit report, their scores don’t improve. Thus, they are at a disadvantage here.

Thus, the creditors and lenders should understand that credit score is not always the sole thing here. The credit scores do not always give you the right picture about the financial condition of a person. It does not always show how responsible a person is.